Pitchbook Healthcare 2024

Pitchbook’s Healthcare Fund Performance Update

Moreover, a significant number of allocators are keen on gaining access to the healthcare sector due to its reputation for being resistant to economic cycles. As per Coller Capital, 87% of Limited Partners view healthcare and pharmaceuticals as appealing sectors for private equity investment in the upcoming two years. Furthermore, numerous LPs acknowledge the long-term trends and opportunities for innovation in the healthcare and life sciences industries, such as aging populations and the demand for substantial enhancements in patient care experiences.

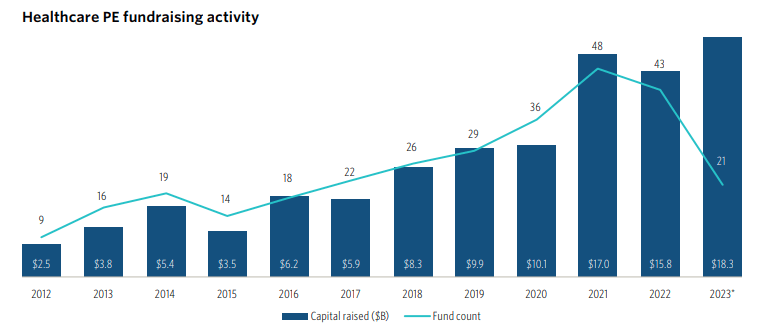

Healthcare specialist fundraising trends

Healthcare-focused private equity fundraising reached a record high in 2023, closing at $18.3 billion by the year's end. This amount continues the rapid fundraising trend initiated by healthcare-focused PE managers in 2021, when fundraising in this sector more than doubled the previous three-year average. However, this increased fundraising activity was primarily seen in larger funds compared to previous years for healthcare-focused PE managers.

This significant level of focus reflects the pattern Pitchbook identified in 2023 for the wider asset category. The proportion of healthcare specialist PE fundraising compared to overall PE fundraising slightly increased from 3.3% to 3.5% in 2023.

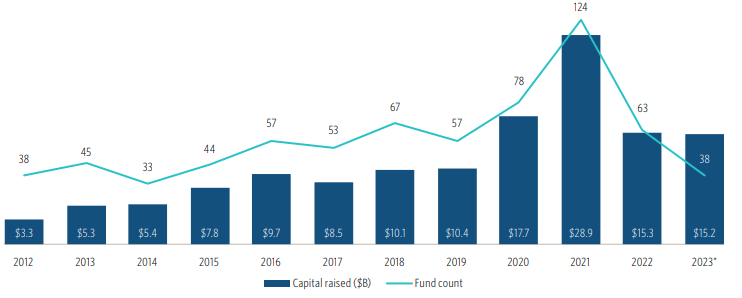

Life sciences VC fundraising activity

Specifically, life sciences VC funds made up 17.2% of all closed fundraising dollars during that year, reaching an unprecedented high while the asset class struggled. Collectively, healthcare and life sciences specialist VC funds represented 22.1% of all VC funding closed.

Healthcare dry powder

Are you a healthcare fund looking for a heavy weight CFO or finance leader?

Signup to receive the latest discipline specific articles

Related articles

Teaser

Finance & AccountingContent Type

General

25/04/24

Summary

Over the years, we have developed a strong reputation as a leading Senior Finance and Executive Search firm. We’re proud to have well-established teams of finance and accounting recruitment cons

by

Neil Burton

Teaser

GovernanceContent Type

Fintech

18/04/24

Summary

The role of risk and compliance in financial services As a sizeable, growing portion of the financial services sector, risk and compliance play a vital role in ensuring that firms conduct busine

by

David Clamp

Teaser

Executive SearchContent Type

General

18/04/24

Summary

Private equity (PE) is a growing industry that has always attracted ambitious top talent due to its high risk/high gain capital investment. Pre-covid, we saw the global private equity industry b

by

Tracey Alper

Related jobs

Salary:

US$140,000 - US$160,000 per annum + Bonus, Benefits

Location:

Fort Lauderdale, Florida

Industry

Energy, Resources and Industrial

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£125,000 - £175,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

Superb opportunity to join this rapidly growing energy efficiency firm as they continue to grow their market share across the US and develop into a leading player in the energy efficient market.

Reference

BBBH180268

Expiry Date

01/01/01

Author

Matthew Fitzpatrick

Author

Matthew FitzpatrickSalary:

£50,000 - £55,000 per annum

Location:

Leeds, West Yorkshire

Industry

Property and Infrastructure

Qualification

Finalist / Newly qualified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Newly Qualified Finance

Contract Type:

Contract

Description

Senior Financial Accountant required for a well established Property Group!

Reference

BBBH178975

Expiry Date

01/01/01

Author

Jaden Alie

Author

Jaden AlieSalary:

Negotiable

Location:

City of London, London

Industry

Consumer & Retail

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£70,000 - £80,000

Job Discipline

Qualified Finance

Contract Type:

Contract

Description

Exciting opportunity for a qualified Finance Manager to join a leading and rapidly growing consumer retail group in Central London.

Reference

JAR2804

Expiry Date

01/01/01

Author

Julia Aruci

Author

Julia AruciSalary:

£75,000 - £80,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

None specified

Market

Financial Services

Salary

£80,000 - £100,000

Job Discipline

Tax

Contract Type:

Permanent

Description

.

Reference

BBBH180245

Expiry Date

01/01/01

Author

Aleksandra Taranovskaja

Author

Aleksandra TaranovskajaSalary:

£50,000 - £65,000 per annum

Location:

West Yorkshire

Industry

Business Services

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£60,000 - £70,000

Job Discipline

Internal Audit

Contract Type:

Permanent

Description

Marks Sattin are currently working with a great technology consultancy business. They are recruiting for an Internal Controls Officer to join the team.

Reference

BBBH180074

Expiry Date

01/01/01

Author

Rajveer Sangha

Author

Rajveer SanghaSalary:

£45,000 - £55,000 per annum

Location:

London

Industry

Consumer & Retail

Qualification

None specified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

A global consumer business is currently seeking a motivated Finance Manager to join their growing team in London.

Reference

KD0707

Expiry Date

01/01/01

Author

Kimberley Donovan

Author

Kimberley DonovanSalary:

£30,000 - £37,000 per annum + +10% Bonus + 3 Days WFH

Location:

South West London, London

Industry

Investment Banking & Capital Markets

Qualification

None specified

Market

Financial Services

Salary

£35,000 - £40,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Contract

Description

We are recruiting for a Collections Account Manager to join a large European corporate banking group, with worldwide jurisdiction on a 12 months Fixed-Term Contract.

Reference

BBBH179942

Expiry Date

01/01/01

Author

Deem NaPattaloong

Author

Deem NaPattaloongSalary:

+ Benefits

Location:

London

Industry

Private Equity

Qualification

Fully qualified

Market

Financial Services

Salary

£100,000 - £125,000

Job Discipline

Qualified Finance

Contract Type:

Contract

Description

Senior Fund Controller (Private Debt Funds) - 12m Contract

Reference

BBBH177293

Expiry Date

01/01/01

Author

Paul Roche

Author

Paul RocheSalary:

£25,000 - £30,000 per annum

Location:

Northwich, Cheshire

Industry

Business Services

Qualification

None specified

Market

Financial Services

Salary

£30,000 - £35,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Contract

Description

Reconciliation Analyst | Northwich | 12 month Contract | up to £30,000

Reference

BBBH180265

Expiry Date

01/01/01

Author

Evie Coates

Author

Evie CoatesSalary:

£30,000 - £34,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

None specified

Market

Commerce & Industry

Salary

£30,000 - £35,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Credit Controller role in Leeds - E-Billing Platforms

Reference

BBBH180131

Expiry Date

01/01/01

Author

Cameron Walsh

Author

Cameron Walsh